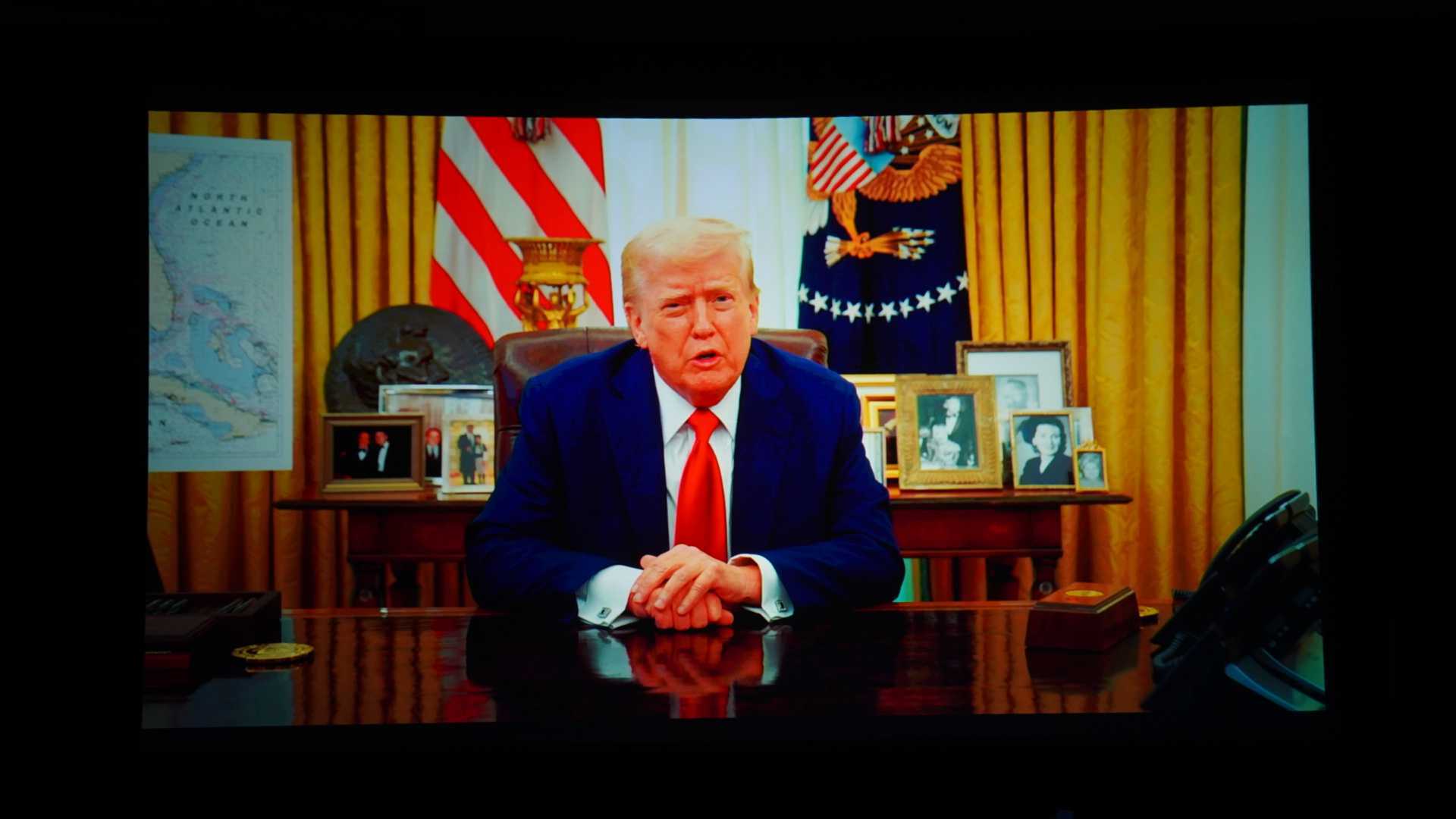

The Impact of Trump’s Tariffs on the Crypto Market

The introduction of stringent tariffs during the Trump administration has opened a new era filled with both challenges and opportunities for the cryptocurrency sector, which often fluctuates in response to global economic shifts. Tariffs inherently raise the price of imported goods, potentially leading to inflation, alterations in supply chains, and variations in currency valuations. In the short term, a stronger U.S. dollar, resulting from trade imbalances caused by these tariffs, may exert downward pressure on cryptocurrency prices as investors seek refuge in more traditional assets. However, if economic instability persists, bitcoin may gain traction as a reliable store of value, particularly if central banks decide to implement looser monetary policies. Market participants are currently anticipating a period of limited price movements in the immediate future, while maintaining an optimistic outlook for the medium to long term.

Market Reactions to Tariff Increases

Rick Maeda, a Research Analyst at Presto Research, noted that Trump’s tariffs—escalating to 34% on Chinese imports and 25% on automobiles from an initial 10%—have unsettled global financial markets, with the crypto sector feeling the impact as well. Bitcoin experienced a decline to around $82,000, while Ethereum saw a sharper drop, falling below the $1,800 mark. In response to this volatility, traders engaged in put buying across various timeframes to protect against potential further declines, although the implied volatility in the options market remained relatively stable. The cryptocurrency market continues to be influenced by Trump’s trade tactics, having previously experienced a similar shock earlier in the year when proposed tariffs on Mexico and Canada were introduced. Without a compelling intrinsic narrative, the crypto market remains closely connected to macroeconomic trends, which may hinder its performance as it continues to be perceived as a risk asset rather than the digital gold it once was.

Short-Term Volatility and Long-Term Prospects

Enmanuel Cardozo, a Market Analyst at Brickken, emphasized that the recent tariffs introduced on April 2, 2025, have significantly impacted the cryptocurrency landscape. Bitcoin had been hovering around $88,500, nearing the $90,000 mark, but quickly plummeted to approximately $82,000 within just four hours. In the near term, these tariffs are creating considerable volatility, leading to a predominately sideways market as economic uncertainty drives retail investors towards safer assets like gold, while institutional investors continue to accumulate Bitcoin. A broader risk-averse attitude is evident, as a recent JPMorgan survey revealed that 51% of institutional traders consider inflation and tariffs to be the primary market influencers this year. However, looking beyond the immediate market turbulence, there is potential for long-term benefits for cryptocurrencies. The tariffs could diminish the dollar’s supremacy by increasing import costs, positioning bitcoin as a viable hedge against inflation. Additionally, as global trade dynamics become increasingly complex, the utility of cryptocurrencies for cross-border transactions may see heightened interest, especially with stablecoins emerging as a solution to tariff challenges.

Bitcoin as a Hedge Against Economic Turmoil

Alvin Kan, COO at Bitget Wallet, pointed out that Trump’s proposed tariffs could ignite stagflation—where prices rise without corresponding economic growth—potentially eroding confidence in fiat currencies, particularly the U.S. dollar. As investors seek refuge from inflation and trade war uncertainties, bitcoin emerges as a neutral, decentralized hedge. Should the dollar’s dominance decline and volatility increase, demand for BTC may surge. In a fragmented and protectionist economic environment, the focus shifts from speculation to asset preservation, prompting savvy traders to prepare accordingly.

Market Dynamics Amidst Trade Tensions

Augustine Fan, Head of Insights at SignalPlus, highlighted that trade partners have promised retaliatory measures, resulting in a significant risk-off movement across various asset classes. This has led to a notable decline in bitcoin prices, mirroring trends in U.S. equities, which have also dropped to recent lows. However, compared to the downturn in traditional markets, cryptocurrencies have shown relative resilience, with Bitcoin maintaining its position above $80,000. The weakening dollar and the rise in gold prices have provided a rationale for some investors to view bitcoin as a safe haven. A statement from Secretary Bessent attributing the sell-off to a “Mag-7 problem” further fueled negative sentiment. The prevailing sentiment appears to favor risk aversion, with expectations that Trump will not quickly reverse his aggressive tariff policies, resulting in U.S. assets potentially underperforming amid an economic slowdown. Market analysts express interest in acquiring Bitcoin during significant price dips around the $76,000 to $77,000 range.

Forecasting Economic Ripples from Tariff Policies

Ryan Lee, Chief Analyst at Bitget Research, remarked that Trump’s unexpectedly severe tariffs, which range from 10% to 49% on various imports, may have triggered a panic-driven sell-off across the broader market. This resulted in notable declines for Ethereum and Solana, both dropping approximately 6%, as fear of economic repercussions prompted a shift towards stablecoins. Beyond the immediate shock, these tariffs could pose threats to the U.S. economy, potentially reverberating into the cryptocurrency markets. Increased import costs, particularly from major trading partners like China, could speed up inflation, with some projections indicating a 2-3% rise in the Consumer Price Index (CPI) by the second quarter of 2025 if trade tensions escalate. Simultaneously, the Atlanta Fed’s GDPNow forecast predicts a 2.8% decline in GDP for the first quarter of 2025, which could worsen as consumer spending and business investments are adversely affected by tariff pressures. A weakening dollar resulting from economic challenges and possible Federal Reserve easing may boost Bitcoin as a hedge, with emerging data indicating early accumulation trends. However, altcoins might require stronger fundamentals to thrive in the long run.